am i taxed on stock dividends

Instead youll pay only when you withdraw money from the account. The dividends cant be non-qualified certain criteria must be met for this and.

Tax Planning For Stock Options

ORC directors proceeded to back-up their words with actions cutting the dividend from 014 to 011 in February to 009 in March to 008 in September 2018 and to 0055.

. Qualified dividend taxes are usually calculated using the capital gains tax rates. 9 rows Dividends are taxed at a 20 rate for individuals whose income exceeds 209425 those who fall. How Are Dividends Taxed.

If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at all. Yes dividends earned on stocks or mutual funds are taxable for the year in which the dividend is paid out even if you reinvest your earnings like through a DRIP. Qualified dividends are taxed at 0 15 or 20.

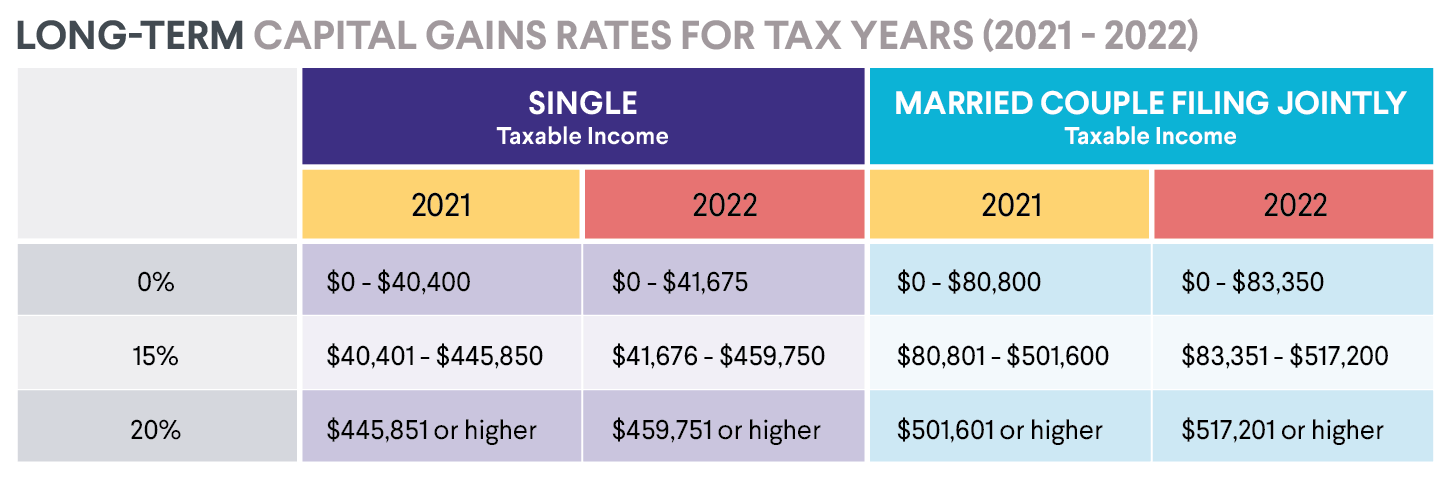

Then the Tax Cuts and. The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. If you are single and earn 445850 or less in taxable income in 2021 you qualify for the 15 tax bracket.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. Invest in stocks whose dividends will qualify for lower rates.

In the case of the cd the 3000 is taxed as ordinary income. If you are in the 35 tax bracket a qualified dividend is going to be taxed at 15. Your taxable income may qualify you for a lower tax rate on dividends.

To summarize heres how dividends are taxed provided that the underlying dividend stocks are held in a taxable account. Pin on Investing. The rate depended on the taxpayers ordinary income tax bracket.

Dividends are reported to individuals and the IRS on Form 1099-DIV. To see why you should have a stocks and shares isa check out trading 212 invest vs isa. In a bracket above 35 percent.

Even if you reinvest all of your dividends directly back into. But if it is an ordinary dividend it will be treated as ordinary income which means the tax hit is. Qualified dividends were taxed at rates of 0 15 or 20 through the tax year 2017.

Ordinary dividends are taxed as ordinary income. Yes the IRS considers dividends to be income so you usually need to pay taxes on them. Long-term capital gains tax rates are usually lower than those on short-term capital.

The tax rate on nonqualified dividends is the same as your regular. Long-term capital gains tax rates are 0 15 or 20 depending on your taxable income and filing status. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent.

The tax rate on. Lastly investors that were in the four middle brackets 25 28 33 or. The top 20 bracket on.

You wont pay taxes on dividend income as it comes in. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. Well lucky you but youll have to pay 20 percent.

Guide To Reporting Stock Investments On Your Return Taxact Blog

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

How To Pay No Tax On Your Dividend Income Retire By 40

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Growth Stocks

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

How You Can Still Earn Money Even If The Market Is Falling Click The Photo To Learn More Ideas Stockmarket Fina Stock Market Investing Strategy Marketing

Selling Stock How Capital Gains Are Taxed The Motley Fool

Pin On Legal Tips For Your Business

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Dividend Tax Rates In 2021 And 2022 The Motley Fool